Be Wary of Stock Market Complacency

February 15, 2014, 5:46 pm

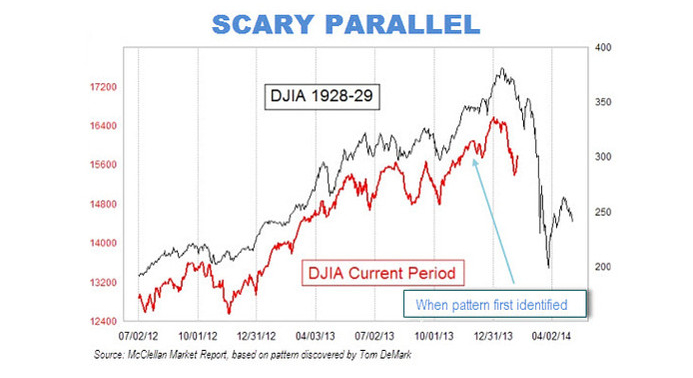

The above chart of the 1929 Dow Jones Industrial Average juxtaposed with today's average is one of many warnings to be careful with this late-stage uptrend.

When history sets-up to repeat itself

One common thread to the story of stock market crashes is, prior to the crash, they're regarded as 'unthinkable' events in the minds of market participants.

In the minds of market participants, the ongoing bull trend has been so long-lasting and so rewarding that they've been lulled into complacency. When the selling escalates to panic, as it always does when there are no more buyers in a raging uptrend, complacency is the reason the crowd gets caught so unprepared.

The present bull market has been one of these prolonged and powerful uptrends. Ongoing since March 2009, this bull market will next month commence its 6th year as the stock market status quo. See:

Moreover, this bull market is exceptional enough to warrant a comparison to the 1920s bull market, above. In the above chart, the similar patterns can be seen today. This curiously also coincides with the 5-year-long bull market that preceded the 'Black Monday' crash of 1987. Here is another chart that juxtaposes 1929 and 1987, from the lesson The 4 greatest trades of all time:

Stock market crashes require an emotional crowd

In all financial bubbles and inevitable corrections, the primary enabling factor is the emotional crowd who becomes fanatical about the uptrend and then too complacent for their own good. In the great bubbles of history, the emotional crowd stands out for their fervor and vindictiveness. See:

While today's stock market is sky-high, perhaps due to the lingering psychological effects of the 2008 crash, at present there may not be exceptionally emotional crowds at work. However, the question must be asked:

Are there emotional crowds out there in this late-stage market?

Evidence of emotional crowds

Vindictive crowds are the epitome of people caught in an emotional trance. While there is little indication to suggest there may presently be that degree of complacency out there right now, there are plenty of people who may be quick to dismiss the downside possibilities. For example, those who don't consider a serious market failure to be a possibility -- thus regarding it unthinkable.

From the Wall Street Journal comes an article that may be indication of such a crowd vulnerable to complacency. The article is about the first chart of this post, the juxtaposition of 1929 and today, and does its best to quell the notion that anything really bad can happen out there in the stock market. Such dismissiveness is a red flag that people may have lost their objectivity:

Comments

comments powered by Disqus