Ray Dalio Explains How the Economic Machine Works

September 15, 2014, 7:21 pm

Founder of hedge fund Bridgewater Associates, which manages over $150 bn, Ray Dalio outlines his framework for understanding an economy, above.

Meet Ray Dalio and Bridgewater Associates

In the video above, the founder of hedge fund Bridgewater Associates details his framework for analyzing where in the economic cycle any economy may be. With over $150 bn in assets under management, Bridgewater Associates is the world's largest hedge fund, stature which was accumulated through a stellar track record spanning more than 30 years. As founder, Ray Dalio is an outspoken billionaire (about $12.5 bn net worth) on the topic of his views of economics.

According to Dalio, most people don't understand how the "economic machine" of an economy works. This leads to lots of unnecessary misunderstanding, as he puts it, and so he has a "sense of responsibility" to share his insights.

The three main drivers of an economy

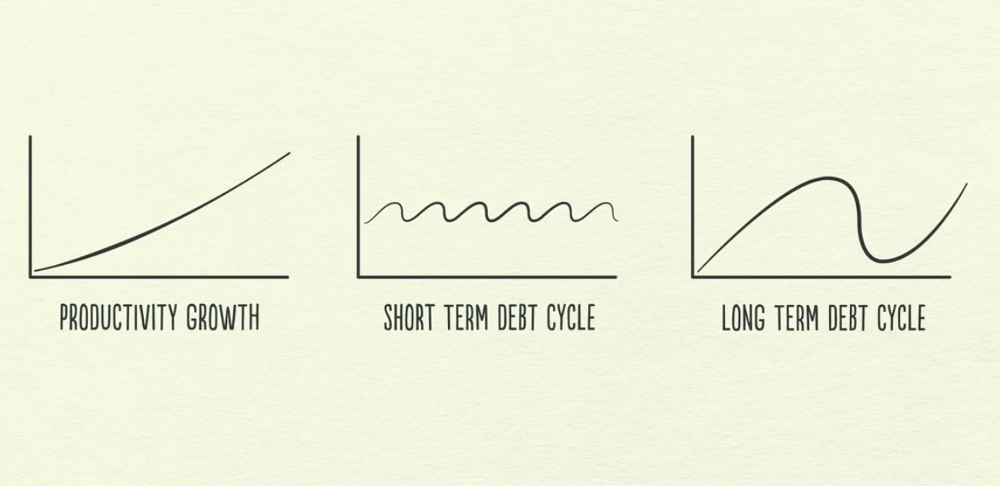

In any economy, there are 3 main economic drivers, according to Dalio. These forces pushing and pulling on what we call 'the economy' are:

- the productivity growth, which depicts the long-term growth trend of an economy

- the short-term debt cycle, which lasts 5-8 years

- the long-term debt cycle, which lasts 75-100 years

Here is a visual depiction:

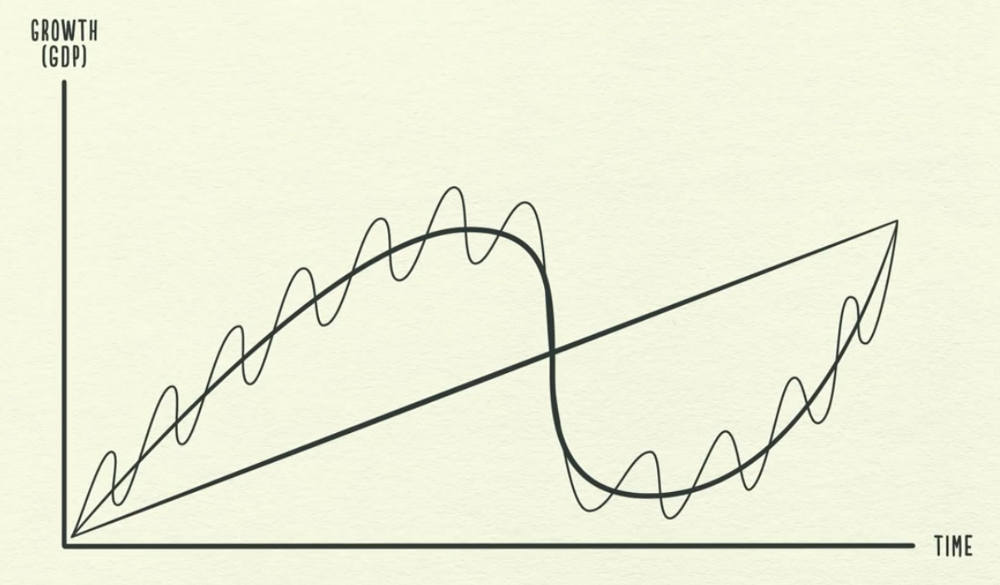

Then, Dalio synthesizes these 3 forces together. This is his playing board for tracking economic cycles:

The role of credit

According to Dalio, the most important -- and least understood -- component of an economy is credit. Credit is hard to see, because it looks and functions identically like real money. However, the big detail is, the amount of credit in an economy dwarfs the amount of money, For example, in the US, there is $50 tr worth of credit, but only $3 tr worth of money. This is why the fluctuations of the growth of credit in the short and long-term are so important.

The Federal Reserve and economic cycles

The most important player in any economic system is that country's central bank, Dalio explains. This is because the central bank monitors the state of the economy and tries to manage the extremes of each economic cycle through controlling interest rates and printing money, according to Dalio. For more on this topic, see the Thirsty Finance lesson that discusses credit, economic cycles and the US Federal Reserve:

So, where are we in the economic cycle?

In an interview last month in Davos, Switzerland, Ray Dalio talks about where he believes the US is right now in its economic cycle. According to Dalio, the US right now is in the middle of a short-term period of credit expansion -- the "boring years" that no one remembers, as Dalio puts it. Europe, he says, lags the US and is in an earlier stage of short-term credit expansion, while China, for example, is at the end of a short-term credit expansion.

Check out the interview here:

Comments

comments powered by Disqus