Inside the upcoming Alibaba Group IPO

August 19, 2014, 5:45 pm

This fall, Alibaba Group of Hangzhou, China, is expected to raise upwards of $20 billion, the most ever raised by a tech company.

What Alibaba's S-1 reveals

Chinese ecommerce giant Alibaba is expected to trade publicly this autumn, raising the largest sum ever raised by a tech company. In their S-1 filing to the Securities and Exchange Commission (SEC), Alibaba reveals a narrative of growth that is firmly rooted in its home market's own economic and technological development.

Founded in 1999 in co-founder Jack Ma's apartment and modeled on the success of companies like eBay, Alibaba offers a number of platforms that help businesses connect with each other and consumers. According to its S-1, 84% of its business derives from mainland China, with the remainder coming from international sources. Total sales volume supported by its commerce platforms last year topped $240 billion USD, a sum triple eBay's total sales volume and double Amazon's.

Moreover, despite just $4.7 billion in revenue compared to Amazon's $74.5 billion, Alibaba last year had income of $1.73 billion -- which is more than double Amazon's income of $750 million -- a fact that points to a robust and profitable business model.

Placing Alibaba's IPO in perspective

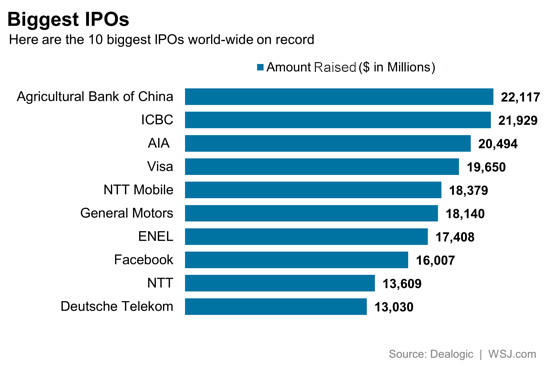

If Alibaba does indeed raise up to $20 billion in the public markets this fall as expected, it will rank as the fourth largest IPO ever. The top 3 companies -- Agricultural Bank of China, ICBC and AIA -- are listed in Hong Kong; Alibaba will list in New York on either the NYSE or Nasdaq:

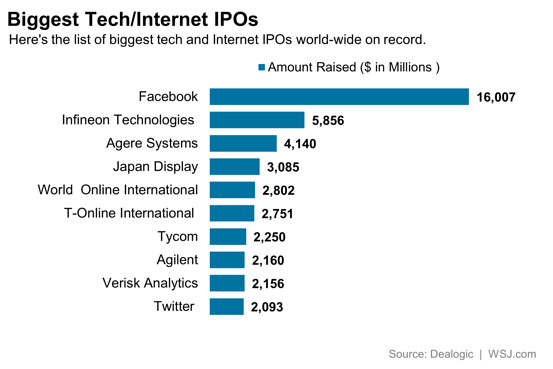

Among tech companies, Facebook's May 2012 IPO is the largest tech company IPO on record, in which it raised $16 billion; a $20 billion IPO would rank Alibaba first among tech IPOs:

Comments

comments powered by Disqus