Ominous Overtones in the Stock Market

April 7, 2014, 2:14 pm

Following a remarkable V-shaped recovery from the March 2009 lows, the S&P 500's 5-year long bull run is showing signs of exuberance.

What's at stake in the stock market

As the above 25-year chart of the S&P 500 shows, the US stock market has been in an incredible bull run since its March 2009 lows from the '08 financial crisis. In fact, over the past couple years, the uptrend has actually gone parabolic -- which means its trendline has become increasingly steep.

This chart also shows that following...

Lessons from a Y Combinator participant

March 17, 2014, 11:19 am

Based in Mountain View, CA, Y Combinator is the leading seed accelerator program in the US for early stage companies and their founders.

What is Y Combinator

Founded in 2005, Y Combinator is a competitive accelerator program for early stage companies. Running 3 month programs in the winter and summer each year, Y Combinator provides its founders capital, training and guidance, and connections to top Silicon Valley investors in return for about 6% of the early stage company's stock.

Participants of the...

Berkshire Hathaway 2013 Annual Shareholder Letter published

March 2, 2014, 3:25 pm

Berkshire Hathaway's annual shareholder meeting, above, is often called 'Woodstock for Capitalists.' Warren Buffett has published his 2013 Annual Shareholders Letter.

Berkshire Hathaway's Annual Shareholder Letter

Since 1965, Warren Buffett has each year penned Berkshire Hathaway's annual shareholder letter. Published in preparation for the annual shareholder's meeting, held in early May in Omaha, the letter doubles as a literary platform upon which Warren Buffett expounds upon recent successes, follies and his overall investment...

Be Wary of Stock Market Complacency

February 15, 2014, 5:46 pm

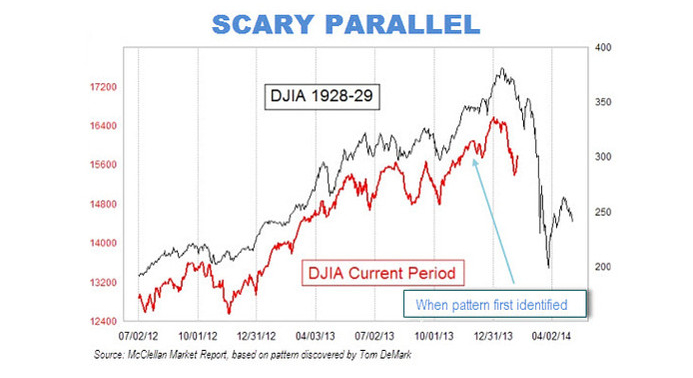

The above chart of the 1929 Dow Jones Industrial Average juxtaposed with today's average is one of many warnings to be careful with this late-stage uptrend.

When history sets-up to repeat itself

One common thread to the story of stock market crashes is, prior to the crash, they're regarded as 'unthinkable' events in the minds of market participants.

In the minds of market participants, the ongoing bull trend has been so long-lasting and so rewarding that they've been lulled into complacency. When the selling escalates to...

The Economist reports on Silicon Valley Startups

February 9, 2014, 8:20 pm

Silicon Valley may be at the cusp of another historical tipping point, says The Economist magazine.

The State of Silicon Valley

In a recently published Special Report on Tech Start-ups, The Economist magazine takes a close look at the state of Silicon Valley, and optimistically declares it may be on the cusp of its next...